PROMESA Has Failed: How a Colonial Board is Enriching Wall Street and Hurting Puerto Ricans

2021 marks the five-year anniversary of the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA), which created a legal framework for restructuring Puerto Rico’s $74 billion debt and established the Financial Oversight and Management

Board (the Board).

Although Congress passed PROMESA to provide much-needed relief to Puerto Rico in the midst of a crushing debt crisis, the Board has used its power to impose devastating austerity measures and negotiate unsustainable debt restructuring plans that enrich Wall Street and hurt Puerto Ricans. These two approaches both stunt economic development and growth, and make it very likely that Puerto Rico’s debt will soon become unsustainable again. The unelected and unaccountable Board has failed to deliver on PROMESA’s key mandates of representing the interests of Puerto Rico in the debt restructuring proceedings, and helping Puerto Rico achieve balanced budgets and regain access to capital markets.

#PRBroken Promises

Read the final report in our yearlong investigation into the Puerto Rican Debt Crisis, its underlying causes, what it means for communities on the island and in the United States, and what we can do to fight back.

Click here for the Social Media Toolkit in English.

Haga clic aqui para el kit de social media en español

The Puerto Rican Debt Crisis

Puerto Rico is embroiled in a humanitarian crisis that is leading to a mass exodus from the island, with a planeload of people leaving with one-way tickets every day. Its unsustainable debt load, stagnating economy, astronomical cost of living, and high poverty rates have made it nearly impossible for many working families to remain on the island. Unfortunately, both the government of Puerto Rico and the US Congress have put the interests of bondholders ahead of residents by paving the way for harsh austerity measures to ensure that bondholders get paid. Our partners have written a series of reports exposing the Wall Street banks that targeted Puerto Rico with predatory and often illegal debt deals, the vulture hedge funds that are trying to profiteer off the crisis, and the public officials that are enabling this piracy.

Click here for information about Banco Santander’s role in the Puerto Rican debt crisis.

ReFund America Project

The US Congress passed the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) in June 2016, which created a Fiscal Control Board to oversee the Commonwealth’s finances. But in order for it to do its job fairly, the Control Board must understand how Puerto Rico came to be so deeply indebted in the first place. The ReFund America Project has conducted a yearlong investigation of Puerto Rico’s debt, releasing a series of reports about the banks that targeted the Commonwealth with predatory, and sometimes illegal, debt deals.

Each piece of research listed below is available to download through the clickable links found in the caption.

May 25, 2017

The Puerto Rico Electric Power Authority’s debt restructuring has been disastrous for Puerto Ricans.

Read the report in English.

Lea en Español.

April 28, 2017

Trump’s Puerto Rico policy is a back door bailout for Goldman Sachs and other Wall Street firms.

Click here to read the report.

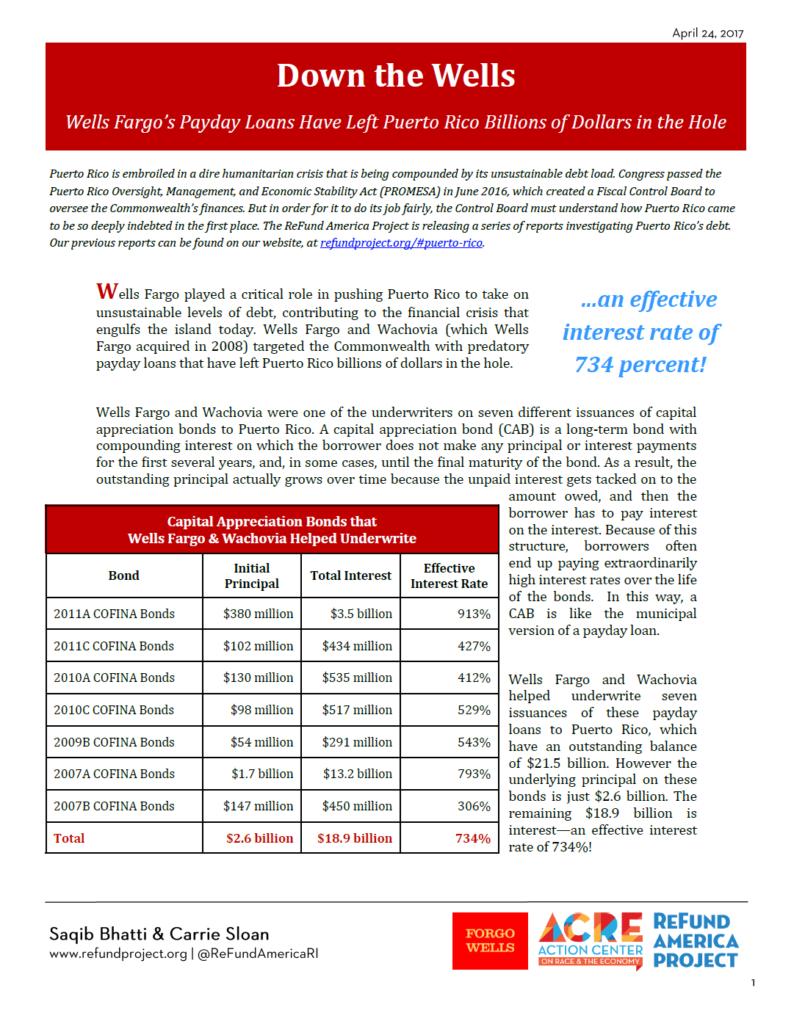

April 24, 2017

Wells Fargo sold Puerto Rico billions of dollars in predatory payday loans.

Read the report in English.

Lea en Español.

February 8, 2017

Wall Street banks targeted Puerto Rico with predatory financial deals like toxic swaps that helped pad bankers’ bonus checks but added tremendous risk to the Commonwealth’s debt portfolio. As the federally-appointed Fiscal Control Board decides how to restructure Puerto Rico’s debt, it must put the interests of Puerto Ricans first.

Read the report in English.

Lea en Español.

August 31, 2016

Wall Street banks convinced Puerto Rico to refinance the same debt over and over again, and charged hefty fees each time.

Read the report in English.

Lea en Español.

June 30, 2016

Banks sold the Commonwealth capital appreciation bonds, which are the government version of a payday loan. Puerto Rico will pay $33.5 billion in interest on $4.3 billion of underlying debt.

Read the report in English.

Lea en Español.

Each report listed below is available for viewing through the clickable link in the caption.